Is Volatility a “bad word”?

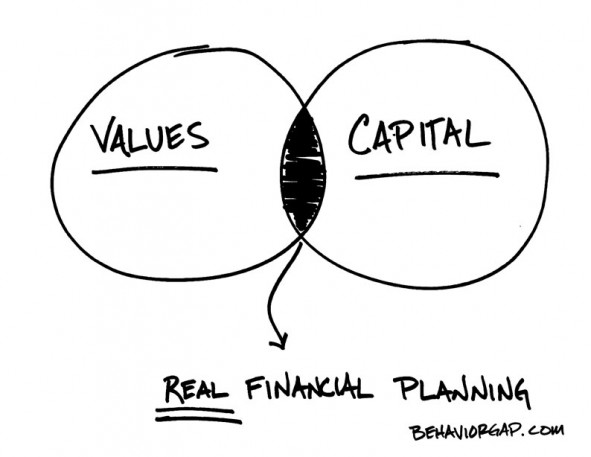

Day to day the global stock markets will swing, sometimes suddenly like a roller coaster. This movement is often referred to as “volatility.” Possibly, volatility is not the best word to use..? Over the long term, day-to-day market swings are insignificant. We at Foley and Foley Wealth Strategies would like to challenge you to reconsider the word “volatility” and how it makes you feel when thinking about your investments. We know it is your hard earned money and we want to help you gain perspective to see opportunities.

I have asked John Foley, our Investment Consultant here at Foley and Foley Wealth Strategies to share a story and his thoughts on volatility.

On Volatility

By John Foley

Changing the way one thinks about money and investing is very difficult; but sometimes breaking it down topic by topic may help some people. In what follows, I will briefly muse on the topic of volatility. I will share the intrinsic problem with the word when it comes to money, the correct way to view volatility in the context of wealth and then a story of a man who exemplified investing virtue through volatility.

When I was thinking about the word volatility, I tried to think of contexts outside of investing where volatility is a good thing. I wanted to make a parallel between that context and financial volatility. However, this task proved to be more difficult than originally expected. I thought of a volatile friend… that example doesn’t work. How about a volatile chemical? That would be one that explodes. BOOM![1] The first two things that came to my mind when I thought about volatility, outside the context of finance, were bad.

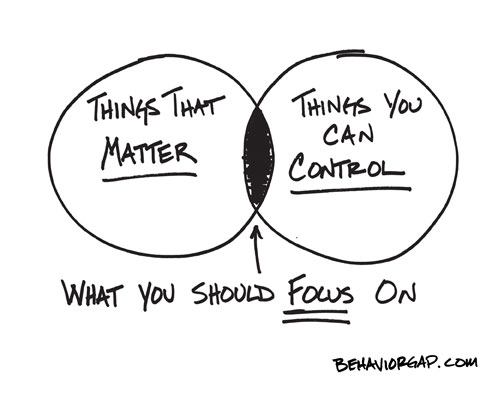

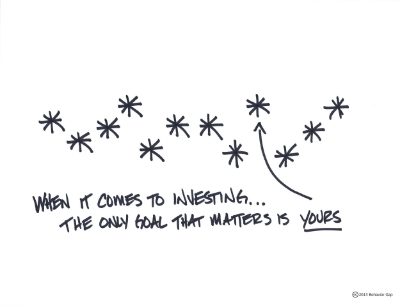

Not only does the word volatile seem bad, there also seems to be a violent nature to the word. Very few people would describe a stock market that moves rapidly up as volatile, even though that is technically volatility. Even fewer people would describe a person who is happy and often gets freakishly happier as volatile. You might call them a spaz or crazy with a smile on your face. But you would not call them volatile. The market has to move down before the news will call it volatile. A person must get angry or depressed for us to categorize them as volatile. It is not good for people to naturally associate a violent word such as volatility with apart of our lives that is as emotional as our wealth or savings. Therefore we should do away with this idea of volatility within capital markets; instead lets’ think of price movements as opportunities to buy items on sale.

Anyone who knows me, knows I enjoy scotch (except for in ‘dry January’). Now, as much as I hate to admit it, scotch is not a necessity. Scotch is a luxury. Furthermore, at the beginning of every year my wife and I anticipate all of our expenses for the whole year. We know that we will spend ~$6,000 on groceries. We will spend about the same eating at restaurants. Fearing judgement, I will reframe from sharing my 2016 scotch budget. But, believe me, my wife and I already know what it is. Having this annual budget in mind in addition to a predetermined value that I am willing to pay for a given bottle of scotch, gives me an upper hand when trying to get the most, quality scotch for my dollar.

With this mentality I welcome downward fluctuations in scotch prices. In fact, one can imagine my delight last year when I saw a bottle of scotch in Germany for half of what it was here in the US. The only fluctuations that are not welcomed, are ones that move the price of my beloved scotch higher. I believe most consumers would share my scotch sentiments about price fluctuations with any item they want to consume…except stocks.

If I were to ask any other scotch drinker if they would prefer scotch prices to be higher or lower one year from now I would unequivocally hear, lower. If I were to ask someone who enjoys eating meat if they would prefer the price of filet to increase or decrease over the next year, I believe they would echo the sentiments of the scotch drinker. However, if I were to ask the common equity investor if they would prefer their stocks to be higher or lower one year from now, most would say higher. So let’s recap. We like buying scotch and we want the price to go down so we can buy more. We like buying steak and we want the price to go down so we can buy more. We like buying stocks but we want the price to go… up so we can buy less?

Okay, maybe I am missing something. Maybe I am making a bad parallel. I got it! Let’s say I want to buy a franchise. To make it concrete, let’s say I want to buy the Dairy Queen in Worthington. The one on high street (because their fudge stuffed cookie à la mode is heavenly). However in this scenario I cannot buy the Dairy Queen right now, but I can buy it a year from now. In this case I would want the price of that Dairy Queen to go up over the next year. This way I could pay more for it. Wait… that’s not right. I would want it to go down. Shoot! That didn’t work. I got it now. What if I already owned half of the Dairy Queen on high street and I wanted to buy the other half next year. Then I would want the price of the Dairy Queen to go up over the next year! Right? Wait, that doesn’t work either.

Okay, so when I am buying, I want the price of scotch, steak or a business, such as DQ, to drop over the next year. Nevertheless, I want my stocks to go up. Why is this? Why do most people want all the items that they consume to go down in price except for stocks? It is because for most people stocks don’t represent a share in a real business they represent wealth. When someone says they would like to buy a DQ franchise, they want it to drop in price over the next year because they understand that it is a business. Successful business owners want to get a business for the best price possible and therefore would like to pay the current owner less than he or she believes it to be worth. But that same person could buy Google stock and want it to go up even though they fully expect to buy more. In this case, Google doesn’t represent ownership in a business that our make-believe friend would like to buy more of. It represents how wealthy our friend is. And for most people, how wealthy one is represents their self-worth (for more on that please see your priest, pastor, rabbi, iman or guru).

If one could stop thinking about stocks and bonds as representations of wealth and think of them as representations of ownership in a business, then one would no longer see market downturns as volatility but as opportunities to buy more. John Train and the hog farmer Mr. Womack offer a great example of correct thinking about investments. Let me share…

* * * * * * * *

Right after John Train was discharged from the Army, at the close of World War II he went into the drilling-rig building business. On the side (and at first as a hobby) he began buying and selling stocks. At the end of each year John always had a net loss. He tried every approach he would read or hear about: technical, fundamental and combinations of all these… but somehow John always ended up with a loss.

It may sound impossible that even a blind man would have lost money in the rally of 1958 – but John did. In his in-and out trading and ‘smart switches’ John lost a lot of money. But one day in 1961 John found himself in the Merrill Lynch office in Houston. He was discouraged and frustrated, when a senior account executive, sitting at a front desk, observed the frown on his face. He had seen this frown for many years so he motioned John over to his desk.

"Would you like to see a man", he asked wearily, "who has never lost money in the stock market?"

The broker looked up at him, waiting.

"Never had a loss?" John stammered.

"Never had a loss on balance", the broker drawled, "and I have handled his account for nearly 40 years." Then the broker gestured to a hulking man dressed in overalls who was sitting among the crowd of tape watchers.

"If you want to meet him, you'd better hurry", the broker advised John. "He only comes in here once every few years except when he's buying. He always hangs around a few minutes to gawk at the tape. He's a rice farmer and hog raiser down in Baytown."

John worked his way through the crowd to find a seat by the stranger in overalls. John introduced himself. He talked about rice farming and duck hunting for a while (John was an avid duck hunter) and gradually worked the subject around to stocks.

The stranger, to John’s surprise, was happy to talk about stocks. He pulled a sheet of paper from his pocket with his list of stocks scrawled in pencil on it that he had just finished selling, and let John look at it. He couldn't believe his eyes! The man had made over 50% long-term capital-gain profits on the whole group. One stock in the group of 30 stocks had gone bankrupt, but others had gone up 100%, 200% and even 500%. The rice farmer explained his technique, which was ultimate in simplicity. When, during a bear market, he would read in the papers that the market was down to new lows, and the experts were predicting that it was sure to drop more, the farmer would look through a Standard & Poor's Stock Guide and select around 30 stocks that had fallen in price – solid, profitmaking, unheard-of, little companies (pecan growers, home furnishings, etc.) and paid dividends. He would come to Houston and buy a $25,000 package of them. And then, one, two, three or four years later, when the stock market was bubbling and the prophets were talking about the Dow hitting 1500, he would come to town and sell his whole package. It was as simple as that.

During the subsequent years as John Train cultivated Mr. Womack (and hunted ducks on his rice fields) until his death, John Train learned much of his investing philosophy. He equated buying stocks with buying a truckload of pigs. The lower he could buy the pigs, when the pork market was depressed, the more profit he would make when the next seller's market would come along. He claimed that he would rather buy stocks under such conditions than pigs because pigs did not pay a dividend. You must feed pigs.

He took a "farming" approach to the stock market in general. In rice farming, there is a planting season and a harvest season; in his stock purchases and sales he strictly observed the seasons. Mr. Womack never seemed to buy a stock at its bottom or sell it at its top. He seemed happy to buy or sell in the bottom or top range of its fluctuations. He had no regard whatsoever for the old cliché – Never Send Good Money After Bad – when he was buying. For example, when the bottom fell out of the bottom in the market of 1970, he added another $25,000 to his previous bargain-price positions and made a virtual killing on the whole package.

John Train supposed that a stock market technician could have found a lot of alphas, betas, contrary opinions and other theories in Mr. Womack's simple approach to buying and selling stocks. But none that John knew put the emphasis on "buy price" that Mr. Womack did. John realized that many things determined if a stock is a wise purchase. But John had learned that during a depressed stock market, if you can get a cost position in a stock's bottom price range it will forgive a multitude of misjudgments later.

John also learned that during a market rise, you can sell too soon and make a profit, or sell on the way down and still make a profit. He would say, “With so many profit probabilities in your favour, the best cost price possible is worth waiting for.” John knew this was always comforting during a depressed market, when your friends would look at you with alarm after you buy when they were selling.

In sum, Mr. Womack didn't make anything complicated out of the stock market. He taught us that you can't be buying stocks every day, week or month of the year and make a profit, any more than you could plant rice every day, week or month and make a crop. John changed his investing lifestyle and has made a profit ever since.[2]

* * * * * * *

Mr. Womack and John didn’t let words like volatility scare them away from owning good, dividend paying businesses. They thought of buying stocks in the same way they thought about pig farming and they were successful investors. I, and everyone here at Foley & Foley, would encourage you to follow in their footsteps. Tell people that you welcome price fluctuation because you are excited to buy businesses cheaper than you could previously. Disregard people that talk about volatility in the markets, as they are implicitly giving a negative connotation when assets go on sale.

To Your Financial Success even in… Market Volatility,

Luke Fields, CFP®

[1] A more educated notion of volatility in chemistry has to do with a compounds’ ability to go from a solid to vapor without becoming liquid. I am using a colloquial understanding of a volatile chemical.

[2] Narrative taken from Ellis, Charles D., and James R. Vertin. The Investor's Anthology: Original Ideas from the Industry's Greatest Minds. New York: J. Wiley, 1997. Print.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Luke Fields and John Foley and not necessarily those of Raymond James. Opinions expressed in the attached article are those of the author and are not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

![SC_Header_600px2a4bf3[1].png](https://images.squarespace-cdn.com/content/v1/54e22be1e4b0f4a6ba36154f/1441378659077-VE0I5M6O2FJZYQE7SW83/SC_Header_600px2a4bf3%5B1%5D.png)