Calling All Control Freaks Adjust Your Focus

What Can You Really Control?

“I will invest in stock XYZ when it gets down to $5 and then sell when it reaches $40 all the while if I see the market is going to go down, I will sell ahead of it.” This is a paraphrased quote I recently heard… Good luck with that plan!! I wish I had that person’s “crystal ball”. Many of us though, have attempted similar plans about something in our lives that we think we can control. Can you really control the stock market, traffic, an upcoming election, other people…? Nope, you just can’t. And if you try, you will be a frustrated mess. As a sometimes “control freak”, this can freak me out!

Change your Focus

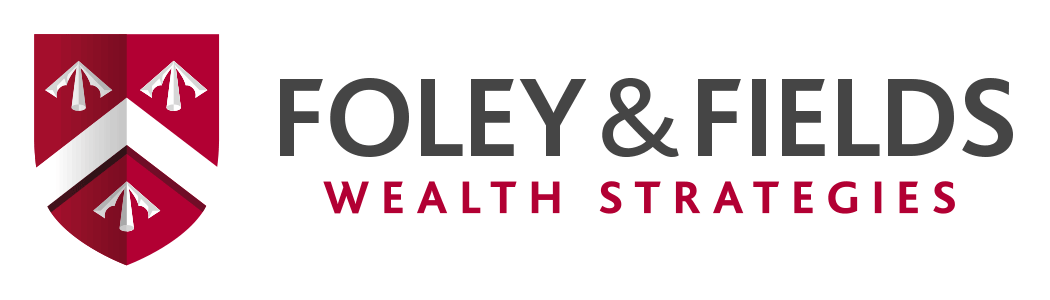

As tough as it is to admit, I can sometimes be a control freak. However, I am learning to let go. What is needed I have found, is a change of focus. The little details we plan out step by step sound great but the reality is those details will need to regularly change with the many variables surrounding every relationship, a deadline at work and even the stock market’s impact on your financial plan. If you can take a step back, “zoom out” so to speak, you will see the big picture. You will then see what really matters to you, your family, profession and the legacy you want to imprint on others.

What Really Matters

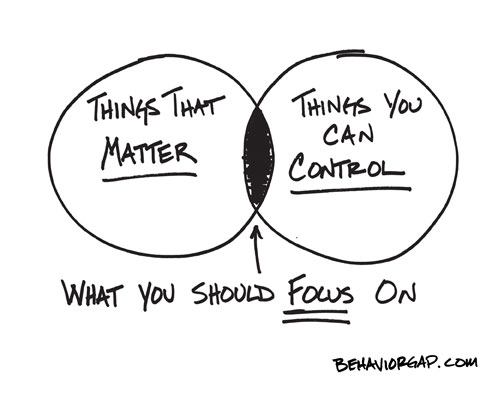

Control tendencies are often birthed from emotional fears. If you can release these fears, you will find freedom. Then you are able to focus on what really matters…. the things you value and which really are your goals. How you spend your time, what you think about, who you spend time with all become a lot easier when you know what really matters, the big picture- where you should focus your energy, time and money on. This is real financial planning.

Allow me the honor to Build for you or Revise your “current” Financial Plan.

Let’s Focus Together on What Really Matters,

Luke Fields, CFP®

How Do You Improve Your Credit Score?

Previously, we discussed how to build credit when you have no credit history. This discussion, is all about how to improve your credit score.

What’s my Score? How do I improve it?

First, it is important to understand how your credit score is calculated. A FICO (Fair Isaac Corp) score is a number on a range from 300 to 850, with a higher number indicating lower risk to potential lenders. Realize though that each lender and their underwriters will view your history different from one another. You can obtain a free credit report and score by visiting AnnualCreditReport.com.

Second, your FICO score is composed of 5 major components and here are some thoughts on how to improve your number. Increasing your credit score will provide you the best terms and lowest interest rates for when you buy a home, car or seek a personal loan.

Payment History 35% Maybe you have missed a payment in the past or been late. Make sure you pay past due debts first, followed by paying current owed. A collections situation, even if paid off, will stay on your history for 7 years. Moving ahead, pay all of your bills on time. Possibly consider setting up payment reminders or automatic payment options.

Amounts Owed 30% Pay off and reduce debts you owe. This is huge for life and financial success well above your FICO score. It is also good to realize that the total amount of available credit currently offered to you- if high, can be a negative on your score even if you are not using it. And if you are carrying a balance and have a high utilization % rate, that will ding your score as well. While reducing debt will help improve your score, the bigger payoff is improving your financial situation and the lasting reward of freedom from debt.

Length of Credit History 15% It takes time to build and show a consistent, responsible use of credit. Don’t cancel credit cards with long history. As well, look for errors on your credit report. Fixing an error will lead to an improved score.

Types of Credit Used 10% A mix of credit cards being paid each month and loans (installments) can show responsible handling of debt.

New Credit Opened 10% Apply for new credit as needed and don’t overdo it. In this thought, also don’t apply for several new cards within a short time frame.

Ask for help. Openly talk with your creditors. They want to be paid back, so they will work with you. Seek wise council- ask someone who has had good credit for many years for advice and/or seek professional guidance as needed. Develop a plan of action and be persistent working towards your goal. Debt can be a useful tool but it has to be understood how it works and used correctly.

To Improved Credit Scores,

Luke Fields, CFP®

Imprinting

Whether you realize it or not, you are imprinting. What is imprinting?

I was speaking with our puppy’s dog trainer a while back and he said this: “Imprinting is really impactful. It is the memory, trust and familiarity your dog will have of you… forever.” At the surface, it made sense in terms of wanting our new family member, “Ollie” to listen to us, trust us, know our voices, remember our scent and be okay with us touching his paws (a big benefit for future nail-clipping :).

In my last writing, I talked about Legacy and the importance of realizing that its impact is happening now, today… not later, “down the road” when you die. I instantly made the connection. There is much more to how a Legacy gets created. It is not just “leaving” a legacy, it is “imprinting” a legacy.

It is Not Just for Dogs

Every day we imprint ourselves on those around us; a spouse, children, friends and co-workers. Wow. Memories of me are being imprinted on those around me, possibly forever. Have you ever heard the often used expression “more is caught than taught”? Imprinting can be verbal but often it is what we don’t say; our actions both good and not so good. I know my kids learn a lot by watching how I handle money, talk with others and how I spend my time. In what I say and do, I want to teach them not only good financial habits but a deep love for God, respect of others and foster a heart of service.

Be Intentional

Imprinting your Legacy goes beyond the important financial habits and decisions we all face. It includes all of life’s possible behaviors and emotions. So as your legacy is being created now, your imprinting on others needs to be intentional. Develop a purposeful plan to imprint and leave the legacy you desire. This is part of the goal discussion when we create a financial life plan for clients.

Imprinting a Legacy,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of Raymond James. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.