Are You Balanced?

Did your IRA, Roth IRA or investment account get rebalanced yet?

They should have been.

Unfortunately, many advisers are unable or unwilling to correctly undertake the task for a variety of reasons. Rebalancing is placing a portfolio back into your correct target allocation of diversified US stocks, international stocks, global bonds, alternatives, cash.

Do You Have a Coach in Your Life?

I have competed athletically my whole life, so I was confident that coaching kids would be a simple endeavor. Wrong. I quickly learned there is much more to being a coach than a player. There is no shortage of what I have learned about myself and my players. Now after specifically coaching my daughter’s team for 4 years I truly love it.

Why I Love Coaching

First, I get to spend time with my daughter and get to know her friends! Coaches played important roles in my life and I love that I can build into their lives today and for the future. My legacy in their lives is happening now and also later.

Second, it forced me to learn and get better. I didn’t know how to coach well, so I had to get some formal training from US Soccer. Now coaching kids makes a lot more sense and I continue to learn more each training session and match.

Third, coaching is direct and honest, which I enjoy. Even a tough conversation is focused to be helpful. My players trust me in that I have their best interests at heart. And I trust that they will listen.

Lastly, the focus is on longer term. The ability to win a game today at the expense of correct strategy and skills is not worth it. My goal is to develop each player to reach their potential, be the best they can be.

The Sports Analogy

This discussion made me realize it really does compare well to my career. Financial planning and advising correctly are just like coaching. Both require passion, education, planning, direct conversations, trust and a long-term outlook.

It is a blessing to work with the families that I choose to advise or “coach”. They trust me as their go to guy. I get to know their families, hear their story- successes and failures, share in their dreams and discuss the possibilities that are ahead, God willing. I am passionate about this.

Education along with real life experience provides something powerful. Competence in what I know, the capabilities of my team and myself and sometimes more importantly, the limits of my expertise… and knowing the need to bring in the correct fellow “coach”, be it a CPA, Estate attorney, Charitable/trust advisor, etc.

Questions to ask yourself

Is your advisor passionate in their career, to learn about your life and see you succeed?

Are your advisors educated, experienced and practical in their approaches? Are they continuing to learn?

Does your advisor speak the language you understand and is willing to have that direct, honest conversation you may need (…not just what you want to hear)?

Do you have a long-term financial plan to help you be the best you can be and reach your goals?

To Your Financial Life Plan,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of Raymond James. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

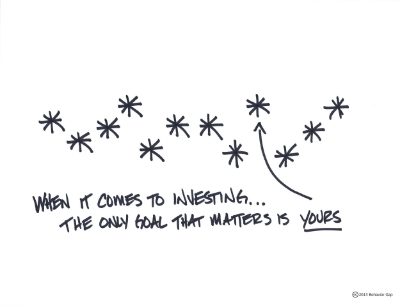

Why You Should Reconsider Your Goals

“What are your goals?” Throughout your life, you have been asked this question; at the start of a school year, on New Year’s Eve, the launch of a new job and of course by your financial advisor. I appreciate goals and the motivation behind them. We do need goals, they provide some direction. But can goals actually limit us?

The Problems with Goals

Goals are absolutely important but issues can arise with them.

“Keeping up with the Joneses“ Goals that others have or we feel everyone should have as basic goals are not individualized. For example, most people do want to be successful, take care of their family and retire someday.

“How do you eat an elephant?” Goals can also be overwhelming to tackle because they are often long term journeys, maybe decades, thus often avoided all together.

“What if we don’t make it?” Goals can be stressful because what if you don’t achieve them? Fear of failure can sell someone short by unintentionally settling on a safe goal that is easier to achieve.

Possibilities You Need to Consider

Take a simple but relevant example of the traditional goal of being “retired” someday. Does the idea of retirement fixate us on the task (goal) or the real desired outcomes (hello all the possibilities)?

"What's money? A man is a success if he gets up in the morning and goes to bed at night and in between does what he wants to do."

-Bob Dylan

Goals do help us focus on tasks and move us in a general direction but can often miss the real desired outcome.

The truth is that most people don’t stop working in retirement, they just shift their work to choosing what they want to do versus having to, possibly start a 2nd career or volunteer their skills to their community.

This example has shifted my thinking on how to converse around goals and dreams. The question I ask now and you need to ask:

What are the possibilities?

Possibilities open the mind to be more creative, dream big and think on the true desired outcome of what could be (not just the tasks to get there).

What you value, what has been laid on your heart and the things you find important will steer this exploration.

Our conversations need to consider the possibilities of big dreams, big thoughts and BIG RESULTS.

Foley & Foley Wealth Strategies

A Uniquely Family Run Business for 35 years

In 1981, Foley and Foley was established when insurance specialist Mark Foley and his investment savvy son, Kevin Foley joined forces to serve clients.

This month, the firm celebrates 35 years serving clients!

Today, Foley & Foley Wealth Strategies is thriving thanks to the continued dedication and success of Kevin Foley and his family of partners, Luke Fields and John Foley. Kevin shares that “we’ve worked to maintain the exceptional standards established early in the company.” Click here to read more about ‘Our Story’.

The firm credits success to their clients trust and satisfaction. By building a financial plan unique to each client, Foley & Foley Wealth Strategies conveys that real wealth comes from planning and living your best life, and being able to pass on the blessings.

Since 1981, Kevin Foley, ChFC®, CLU®, has specialized in helping clients accumulate, manage and preserve wealth and been recognized as an outstanding financial advisor, achieving membership in the Raymond James Leaders Council.

Luke Fields is a CERTIFIED FINANCIAL PLANNER™ Professional with a thorough understanding of the details required when constructing strategies for clients. John Foley, RJFS Investment Consultant, specializes in consulting with clients to determine which investments will help them accomplish their unique goals.

In recent years, Foley & Foley Wealth Strategies has modernized our firm processes, created a new logo/website www.foleywealthstrategies.com, enhanced the investment selection process to be discretion managed in-house and implemented the most current financial planning software adding significantly to their investment and financial planning strategies. These changes convey a readiness, vibrancy and current understanding of today’s challenging markets.

Foley & Foley Wealth Strategies THANKS YOU! We pledge to you our continued best service – you deserve it!

Kevin Foley ChFC®, CLU®, Founding Partner

Luke Fields CFP®, Firm Partner

John Foley, Firm Partner, Investment Consultant, RJFS

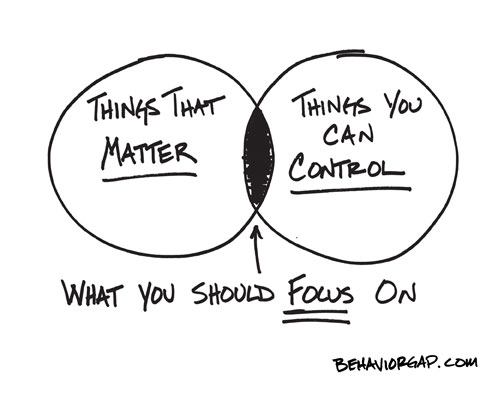

Calling All Control Freaks Adjust Your Focus

What Can You Really Control?

“I will invest in stock XYZ when it gets down to $5 and then sell when it reaches $40 all the while if I see the market is going to go down, I will sell ahead of it.” This is a paraphrased quote I recently heard… Good luck with that plan!! I wish I had that person’s “crystal ball”. Many of us though, have attempted similar plans about something in our lives that we think we can control. Can you really control the stock market, traffic, an upcoming election, other people…? Nope, you just can’t. And if you try, you will be a frustrated mess. As a sometimes “control freak”, this can freak me out!

Change your Focus

As tough as it is to admit, I can sometimes be a control freak. However, I am learning to let go. What is needed I have found, is a change of focus. The little details we plan out step by step sound great but the reality is those details will need to regularly change with the many variables surrounding every relationship, a deadline at work and even the stock market’s impact on your financial plan. If you can take a step back, “zoom out” so to speak, you will see the big picture. You will then see what really matters to you, your family, profession and the legacy you want to imprint on others.

What Really Matters

Control tendencies are often birthed from emotional fears. If you can release these fears, you will find freedom. Then you are able to focus on what really matters…. the things you value and which really are your goals. How you spend your time, what you think about, who you spend time with all become a lot easier when you know what really matters, the big picture- where you should focus your energy, time and money on. This is real financial planning.

Allow me the honor to Build for you or Revise your “current” Financial Plan.

Let’s Focus Together on What Really Matters,

Luke Fields, CFP®

How Do You Improve Your Credit Score?

Previously, we discussed how to build credit when you have no credit history. This discussion, is all about how to improve your credit score.

What’s my Score? How do I improve it?

First, it is important to understand how your credit score is calculated. A FICO (Fair Isaac Corp) score is a number on a range from 300 to 850, with a higher number indicating lower risk to potential lenders. Realize though that each lender and their underwriters will view your history different from one another. You can obtain a free credit report and score by visiting AnnualCreditReport.com.

Second, your FICO score is composed of 5 major components and here are some thoughts on how to improve your number. Increasing your credit score will provide you the best terms and lowest interest rates for when you buy a home, car or seek a personal loan.

Payment History 35% Maybe you have missed a payment in the past or been late. Make sure you pay past due debts first, followed by paying current owed. A collections situation, even if paid off, will stay on your history for 7 years. Moving ahead, pay all of your bills on time. Possibly consider setting up payment reminders or automatic payment options.

Amounts Owed 30% Pay off and reduce debts you owe. This is huge for life and financial success well above your FICO score. It is also good to realize that the total amount of available credit currently offered to you- if high, can be a negative on your score even if you are not using it. And if you are carrying a balance and have a high utilization % rate, that will ding your score as well. While reducing debt will help improve your score, the bigger payoff is improving your financial situation and the lasting reward of freedom from debt.

Length of Credit History 15% It takes time to build and show a consistent, responsible use of credit. Don’t cancel credit cards with long history. As well, look for errors on your credit report. Fixing an error will lead to an improved score.

Types of Credit Used 10% A mix of credit cards being paid each month and loans (installments) can show responsible handling of debt.

New Credit Opened 10% Apply for new credit as needed and don’t overdo it. In this thought, also don’t apply for several new cards within a short time frame.

Ask for help. Openly talk with your creditors. They want to be paid back, so they will work with you. Seek wise council- ask someone who has had good credit for many years for advice and/or seek professional guidance as needed. Develop a plan of action and be persistent working towards your goal. Debt can be a useful tool but it has to be understood how it works and used correctly.

To Improved Credit Scores,

Luke Fields, CFP®

How to Build Credit...When You Have None.

So you want to build credit but have no credit history? You have no credit history and can’t get a credit card. How do you build credit? I have heard this question several times recently, so I wanted to provide some advice. Pass this on to your kids, grandkids and friends if you have already begun your own credit journey.

Why You Want Good Credit

Think of credit as the trustworthiness that a lender has in you to repay them. Would you loan money to someone you didn’t trust? Probably not. FICO (Fair Isaac Company) started in 1956 to provide a numeric measure of a person’s credit worthiness. If you want to someday buy a car, a house to call your own or get a loan to start an entrepreneurial business, you likely will need money. If you have a history of responsibly paying back your credit on time and in full, it is much more likely you can get the money you need. If your FICO score is high, considered good or excellent (720+), you will enjoy the lowest interest rates and terms for your loan.

The Credit Rules to Live By

Only use credit cards or get loans for items that:

1) You actually Need. “Need” meaning items that you would buy with cash anyways; gas, groceries, utility bills and if still in school/grad, then tuition, fees, etc.

2) You have the cash in the bank to pay for what is charged on the credit card or the loan payments you owe. My kids know this one… Cards can be convenient but you only can buy want you can afford. You owe what you “swipe”.

3) You can pay in full, 100%, on time and every month. This is the single most important factor in building credit and a high FICO score. It will also save you from paying high interest rate charges and fees.

Ways You Can Start Building Credit

- Open your first starter Credit Card. Visa, American Express, etc. Many of these companies offer “student” credit cards if you are still in school or grad school.

- Get a Gas card. Shell, Conoco, Exxon, etc. Remember, this is only for what you need and would buy anyways- gas to get to work or school… not beef jerky and gum inside the “quickie-mart”.

- Become an “Authorized User” on someone else’s credit card. A Family member may allow you to do this, but hopefully with a watchful eye. This will help you build credit but beware to them; you are not legally obligated to pay for charges.

- Be a Co-signer on a loan. Need a car? Well those (affordable) car payments, paid in full and on time can build credit. Again, the main signer for the loan is legally obligated.

- Get Credit for the Rent you already Pay. Check out rent reporting services such as Rental Kharma and RentTrack. This will usually help build credit but not all credit scores take this into account.

What’s the best card?

It really depends. Check out WalletHub to review their top picks.

A few tips though. Typically it is best to avoid a card with an annual fee, however a low annual fee may be okay if you can pair building your credit with receiving reward points that you will benefit from, such as cash back, flexible point systems or airline mileage cards if you plan to travel often. If you are unable to obtain one of these traditional cards, you may need to start with a “secured card”, where you place a security deposit on the card.

Another tip: Check your Credit Report and Scores regularly. You are entitled to one free report every 12 months from each of the three credit bureaus, Experian, TransUnion and Equifax. So that is 3 free each year. Go to AnnualCreditReport.com to check your credit score.

Further questions about how to build credit or credit in general? Explore Experian’s site (one of credit agencies) or shoot me an email anytime. Luke.fields@raymondjames.com

To Wise Credit Use,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James, and are subject to change without notice. Information provided is general in nature. Past performance is not indicative of future results. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Imprinting

Whether you realize it or not, you are imprinting. What is imprinting?

I was speaking with our puppy’s dog trainer a while back and he said this: “Imprinting is really impactful. It is the memory, trust and familiarity your dog will have of you… forever.” At the surface, it made sense in terms of wanting our new family member, “Ollie” to listen to us, trust us, know our voices, remember our scent and be okay with us touching his paws (a big benefit for future nail-clipping :).

In my last writing, I talked about Legacy and the importance of realizing that its impact is happening now, today… not later, “down the road” when you die. I instantly made the connection. There is much more to how a Legacy gets created. It is not just “leaving” a legacy, it is “imprinting” a legacy.

It is Not Just for Dogs

Every day we imprint ourselves on those around us; a spouse, children, friends and co-workers. Wow. Memories of me are being imprinted on those around me, possibly forever. Have you ever heard the often used expression “more is caught than taught”? Imprinting can be verbal but often it is what we don’t say; our actions both good and not so good. I know my kids learn a lot by watching how I handle money, talk with others and how I spend my time. In what I say and do, I want to teach them not only good financial habits but a deep love for God, respect of others and foster a heart of service.

Be Intentional

Imprinting your Legacy goes beyond the important financial habits and decisions we all face. It includes all of life’s possible behaviors and emotions. So as your legacy is being created now, your imprinting on others needs to be intentional. Develop a purposeful plan to imprint and leave the legacy you desire. This is part of the goal discussion when we create a financial life plan for clients.

Imprinting a Legacy,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of Raymond James. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

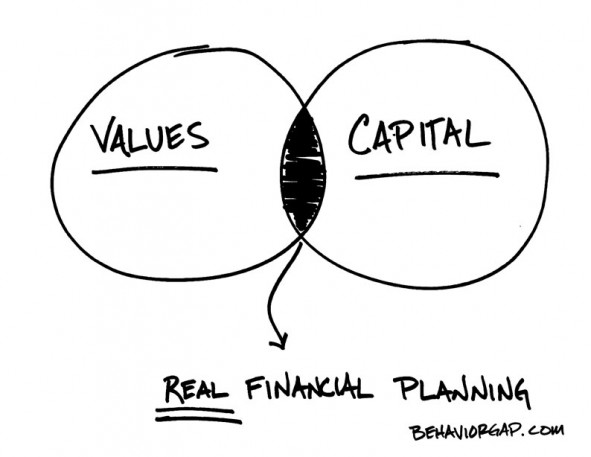

Values = Goals

Do Yours Match Up?

Discovering how your Values should shape your Goals

What are the most important things in your life?

What motivates you?

What or whom do you care about most?

Important questions. Questions for you alone to answer. I will not dare tell you what your answers should be.

Why are your Values so important?

Values are what matters most to you. Values shape your everyday decisions, impacting your short term and long term goals.

Need an exercise to help determine Values?

Values and goals directly impact your financial life.

1. Values shape your Goals (both short and long term).

2. Goals allow you to develop a Financial Life Plan.

3. A Financial Life Plan Directs How to invest, Whom to insure and Where to give your assets and wealth.

I would love to hear your thoughts on this and what you really value and your goals. Please send your comments to me at luke.fields@raymondjames.com or comment on LinkedIn or Twitter.

-Luke Fields, CFP®

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Financial Planning is NOT...

Financial Planning is NOT...

I met with a great couple the other day. As we chatted, I asked if they had a financial plan- “ah yes, we think we do….” was their answer, so that means no. We discussed some additional items and it became even more clear that their investments, insurance and current advisor were not coordinated and planned out well. I see this again and again with many prospective clients regardless of their age and their net worth. It is a common problem and it frustrates me. This is not their fault and I don’t blame them one bit. After all, how are they to know? It is one thing if a person knows that they have “some investments” that a stock broker, registered representative or insurance agent placed them into (or worse yet, sold them). Their expectations are correct that it is simply an investment relationship. However, it’s another thing if people believe they are getting more service, like a “financial plan”. In reality they are majorly under-served while likely overpaying and worst yet headed down a dangerous path. Let me explain.

Financial planning is NOT a 1x event. A financial plan is a living, breathing plan that updates with the twists of life and the many different stages you encounter. It is an ongoing process. It is online and readily available to review.

Financial planning is NOT a product, investment or stock that you buy. These should be seen as the potential vehicles for your unique situation (if appropriate) to make your plan work correctly, not the miracle cure (since the “last thing we tried didn’t work”).

Financial planning is NOT a vague ideal or attitude such as, “save as much as you can and we will figure out what you can do down the road.” Sadly, I have heard of other so called “advisors” saying things like that. Here is the truth… financial planning is rooted in your goals and what is truly important to you!

Financial planning is NOT a huge stack of papers that lists of 15 things to immediately do (mostly on your own). Good planning is accomplished in a modular method, one manageable step (or two) at a time. This is realistic.

Financial planning is NOT a quick or easy strategy. It takes expert advice, patience and good habits over time to reach success. You need a qualified and competent advisor to help you realize your goals.

Remember a good and useful financial plan starts with what you value. What you value should naturally direct your goals. And your goals then dictate what investment, insurance, tax, estate methods we use to help you achieve success in your plan.

To your Financial Plan,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion area as of this date and are subject to change without notice.

Sketches are courtesy of BehaviorGap

Things that Frighten Me... as an Advisor

Things that Frighten Me… as an Advisor

I hate snakes. My wife hates spiders. We make a great team. I can save her and she can torture me. Beth is extremely scared of spiders, even small ones. She has a unique set of screams corresponding to the spider size that I have learned to decipher over almost 15 years of marriage. A few weeks ago, Beth caught a snake in the woods behind our house and called me at work to tell me we had a new “family pet”. Let me be clear, that “pet”, upon my arrival home from work, was quickly released back to the wild (by her).

Over the years, readers of Stewardship Cents have learned that I love the Fall season and also occasionally giving others a little scare around Halloween time. Somehow my kids now, all throughout the year, regularly try to scare each other and their parents. Who taught them that?! There are a few things that scare me besides my 7 year old jumping out of his closet.

What Frightens me as a Financial Planner and Should Frighten You as Well

Not enough Life Insurance or none at all

This is a basic planning strategy but often lacking for most families. Life insurance is affordable for most people and provides protection for your loved ones. For many families, having $1 Million dollars of death benefit still isn't enough. Really! I can explain why.

Unsure where the Money Went

Whether you make $35,000 a year or $35 Million, everyone has to have a budget. You have to know where your money went (expenses) and why the money was spent on that item(s). This information enables you to be a good steward of the resources you have and allows you to live within your means.

Lack of a Good Financial Plan

So, where are you going financially? A simple question, but often unknown by most families... that is SCARY. Is the direction you are headed where you want to go and will you be happily or sadly surprised when you arrive? Ask yourself these questions; what do you truly value and what is important to you today and what will be important to you tomorrow? This is why a financial plan is necessary for everyone.

Avoiding Stocks

The media has done a good job of making people scared of stocks due to the volatility seen in recent years. However, the truth is...volatility is a normal part of the market and other major investment categories like metals (gold/silver), bonds and currencies- can often be even more volatile than stocks. Stocks over longer time-frames of 7+ years typically provide good returns and help maintain your purchasing power. In my opinion, everyone, even retirees, need a healthy portion invested in a diversified portfolio of solid, large company stocks. Good financial planning helps highlight this need over a lifetime.

An Estate Plan that only consists of Dying someday

If your only plans for your estate is that you will die, well it may be a little short-sighted. Who do you want to inherit your money and assets? Do you have specific wishes for your loved ones and charitable organizations to follow? Have you ever heard of probate court? You want to avoid it.

No Personal Disability Policy

Disability is more common than most people think, especially short term issues. Often employers provide some coverage, typically 60% of salary but it is almost always never enough. Sixty percent sounds decent but after taxes it is a far cry from your family's regular income. You need a supplemental policy to fill this gap of lost income.

Expectation that Social Security will be your Retirement

Social Security is currently solvent and a major portion of most retirees' income. However, 15 or 20 years from now social security will likely look rather different for new enrollees. You can't count on it to be there and it will not provide a comfortable retirement. You have to save for yourself and whatever benefit you may receive from Social Security can be the "icing on the cake."

Here is the Truth

The truth is that each of these frightening scenarios can easily be resolved through discussion and proper planning. I understand that it can be hard to address these topics; sometimes it is hard to find time, gain agreement from your spouse, admit that these issues exist or simply it can be difficult to determine who you can trust. It is my joy to assist clients and new people I meet with these issues and many more planning strategies. With over 35 years in the business, our firm is well-positioned to assist you or someone you know.

So don't be frightened any longer, let's face these fears together. No snakes though.

Luke Fields, CFP®

READ more Stewardship Cents here...

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance may not be indicative of future results.

Have you had “THE TALK” with your parents?

Have you had "THE TALK" with your parents? Nope, not the birds and the bees... I am not about to help you with that talk. Our daughter is asking enough questions on that. I am talking about the discussion regarding your parents' finances. Both of these talks can be awkward for many. Well, if you haven't yet had the money talk, you are not alone. The majority of adult children have little to no idea of their parent's true financial situation. Like the sex talk, parents' sharing their financial situation with their adult children is often a conversation avoided.

Why is that?

Here are some common reasons why parents don't talk with their adult children about money...

Do any of these apply to your family?

1.) "We have never talked about money"

When kids are young it is thought to be a good idea to avoid discussing money so the child doesn't worry and feels secure. While good intentioned, it doesn't help that child become financially wise themselves and never discussing money can make very important future discussions awkward to approach for both parent and kid alike.

2.) "It's none of their business"

This mentality sometimes comes from embarrassment of past mistakes, the idea that I don't want my kids to worry about me now (similar to when kids were young) or the parent simply feels it is a private matter, essentially that "it is none of their business." Parents may have given off an image of wealth or success and are reluctant to share the reality that things are not as good as they look. And for some parents, if wealthy, they may feel their kids may try to take advantage of them.

3.) "I don't want to talk about my death"

Mortality is not a fun discussion for the parent or the child. Obviously, it can stir many emotions- but like taxes, death is certain. Everyone has specific desires and requests in regards to their estate, whatever the size and more importantly, their legacy. Often discussing money is just the initial conversation that leads to great discussions on deeper family matters. How does a parent want to be remembered? Are their specific belongings that they want to go to a particular child or family member? Is there a church or charity that they want to gift money to? Even discussions on how a funeral service should be constructed. The list goes on and on.

4.) "I am afraid it will change their motivation"

This seems like a reasonable excuse but the truth is, by the time a parent is in their retirement years and their kids are correspondingly in their late 30s or 40s+... if that child is not already motivated in their career and to provide for their family, little is likely going to change in their attitude if they find out the parents are going to leave them a "pile of money." They will continue to be motivated. In fact, if a parent shares that things aren't great for them and share the things the wish they would have done differently... financially smart kids will probably get wiser and those children that are not motivated may actually get stirred to improve their own situation (especially knowing not to expect a large inheritance).

Breaking the Ice

If you find yourself in this situation as a parent who hasn't talked to your adult children or as the child trying to consider how to bridge this discussion, here are some tips. The idea is to just get the conversation started. It typically continues once the ice is broken.

Bring the topic up from your own perspective.

Start with your personal situation as the bridge. Being vulnerable is always a good way to encourage others to open up. "Dad (or Mom) recently I (we) have been making some plans on our estate (will/trust) and it made me curious about your desired plans?"

Ask for whom to reach out to.

Often the most honest and straightforward approach works best. Simply ask, "Mom, Dad who should I call if something happens to you suddenly" or "where are your documents that I should know about?" Let your parent know you want to be ready to help if they need somebody to step in for them to pay bills or talk to their doctor. This is where a power or attorney (POA) is a critical legal document.

Use a possession known to the whole family as a concern.

This can be a tricky option but effective in opening the door to conversations because everyone will know it needs to be addressed. "I am worried that it's not clear what you want us to do with dad's autograph collection (the vacation home, mom's jewelry, etc) if something were to happen to you. I want to make sure that your wishes are fulfilled and there is no possible confusion among my siblings as to what to do." Pick an item that is important to them to discuss or a decision that is important such as funeral arrangements, burial, etc.

Use your financial advisor as the impetus for the discussion.

Financial planning is my passion and I am more than willing to be the "scapegoat" to help a family discuss such important matters. "Our advisor suggested we find out how we can assist you with your plans. He wants us to know your expectations and be prepared to help you." It is common that children are named as a trustee or executor of an estate. Sometimes they don't even know it until a parent passes or is incapacitated and needs them to step in to assist. Talk about shock and being unprepared to help at a tough time, while dealing with the stress and emotions of a death or illness of a parent.

The REALITY like it or not

The reality is whether you are comfortable talking about money or not, money is an important part of everyone's life. Yes, for some parents their financial situation can be a taboo topic and a personal matter. But it cannot be ignored! If it is disregarded, it will likely cause larger and more complex problems later in life and especially upon a parent's death. Most parents when made aware of possible issues would rather not leave a mess for their kids to figure out. Talking sooner than later will open up communication, help children know how to assist their parents, get parents desired plans in place legally and set their children's expectations.

We regularly encourage and assist our clients in starting the conversation about family finances. This is what comprehensive financial planning involves. The advisor you use should be thinking in these terms to be truly effective for your family's financial life plan. If you need some additional ideas or help, please feel free to reach out to me.

Luke Fields, CFP®

Who Will Get Your Money?

It is important to save and plan ahead. We all probably agree on that. When it is all said and done, “you can’t take it with you.” So who will get your money someday?

Lucky Dog

In recent years there have been stories of wealthy individuals leaving significant money, even fortunes to pets. That may not be your idea of how you want to leave a legacy, but these individuals planned well to make their desires happen. One of the more famous stories is of Leona Helmsely, a successful businesswoman who left $12 million to her dog, Trouble. There is also a story of a German countess, Karlotta Liebenstein, who in 1992 left $80 million to her German shepherd Gunther III and allowed in her legal documents for the money to pass to her dog’s offspring. With good investing by the managers, Gunther IV is now enjoying an estate of $372 million. Wow.

When you pass, your money should go to those you intend to inherit your estate, whether family, friends, charitable organizations or even a pet, if you wish. Proactive planning is required to ensure your wishes are accurately fulfilled.

6 Common Beneficiary Mistakes to Avoid

1.) Not Naming a Beneficiary or Listing your Estate. If no beneficiary is listed, it goes to probate. If you list your Estate, it goes to probate. This is completely avoidable. These mistakes would prevent your spouse or kids from being able to use what is called a “Stretch” IRA, where the beneficiary can spread payments over their lifetime; which typically reduces taxes paid and can increase the potential growth of the assets. It is almost always best to avoid Probate. Many courts will take a year or longer to finalize the estate, attorney fees will mount and there will be a delay in the beneficiaries receiving the assets.

It is almost always best to avoid Probate

2.) Not Listing a Contingent Beneficiary. What happens if you are killed in a car accident with your spouse, who typically is the Primary Beneficiary? Hello Probate Court again. You need to have Contingent or what I call “next in line” beneficiaries listed; typically these are your children (possibly grandchildren or a charitable organization if you don’t have children).

3.) Failing to Keep Forms Up-To-Date. Unfortunately, there are cases where ex-spouses have inherited accounts because beneficiary forms were not updated. As well, possibly other previous named beneficiaries have passed away or a relationship has significantly changed. If you are re-married you will want to decide how to handle your assets if you were to pass away. Your new spouse will need to sign a consent form if your assets are intended to go to your children directly. Additionally, you may need to setup a Trust if you desire for your new spouse to be supported by your assets if they survive you, and then have the money transferred to your own kids. We have seen cases where the money goes to the surviving spouses (2nd marriage) own children, not the intended biological children of the 1st spouse to pass. It can get ugly. I can refer you to great Estate Planning attorneys for these needs.

Beneficiary forms override your will

4.) Failing to List Beneficiaries On ALL Your Accounts. Does your 401k or 403b at work have listed beneficiaries, and have they been updated? Your IRAs, Roth IRAs, joint investment brokerage account(s), insurance and even your bank accounts should have beneficiaries listed. This will avoid Probate and give your beneficiaries quicker access to the assets. A Transfer on Death (TOD) can be used for joint investment accounts and a Payable of Death (POD) is used for bank accounts. Too often we see new clients and prospects come into our firm with beneficiaries listed incorrectly on their accounts.

5.) Naming a Minor as Beneficiary. It is questionable if many adults are even responsible enough to handle suddenly inheriting significant amounts of money… so how about your teenager? Although it is good to have your kids named as contingent beneficiaries it can cause problems. Financial control is often a concern- some beneficiaries will always raise concerns and/or there are often very specific wishes that someone will want carried out upon their death. This again is an example of where speaking to an attorney is wise and using a Trust can assist in this situation.

1.) Forgetting to Choose a Guardian. You’ve named the beneficiary and determined what financial control you wish to put in place and even designated who is the Trustee of the assets. But did you name a caretaker of your minor children (or the grandchildren you care for)? This is vital. Would you rather the court appoint a guardian for your kids or you choose..? I think we know the answer to that one.

So, WHO Will Get Your Money?

These mistakes are simple to avoid and it is obvious why you should take action. However, too often I find that people put off these critical and basic estate planning steps. It is also common for people to forget to update and adjust beneficiaries as life changes. This is even true for many people who are working with “financial advisors” out there. Estate planning is a critical process that our firm incorporates into our client services. If you are unsure of whom your beneficiaries are or would like to discuss some ideas, please reach out to our office.

To Your Financial Planning Success,

Luke Fields, CFP®

luke.fields@raymondjames

877.854.0936

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

Do You Dream?

STEWARDSHIP CENTS NEWSLETTER

How Big Are Your Dreams?

Recently, I was chatting with a CPA about helping clients reach their goals. He shared that he often sees people that need to be pushed to not just dream, but to dream bigger. I completely agree. So, why do so many of us fail to dream? I think it is because many of us lack clear goals and a planned direction on how to move forward. Too often we settle for where we find ourselves or don’t realize the potential ahead of us. We need to dream big!

Last month I asked all of us to consider three simple questions:

1. What do I value?

2. What is most important to me?

3. How does this change my life and goals?

Thank you for the feedback I received from many of you; I am glad these questions were thought provoking. Answering these questions helps determine what is most important to you. This is critical because what is important to you is the starting point to setting your goals.

The next common problem is what I opened this discussion with… how big do you dream? Often I find when people have done the work and identified important goals, they still hit a wall in their progress to achieve them.

1. Some people need to dream bigger.

2. Some people need to be realistic (this is more rare).

3. Some people have dreamed BIG- but have no idea how to accomplish their goals.

All of these situations require discussion, for us to be either “pushed forward” to go bigger in our dreams or “pulled back” to start at more realistic goal levels. So how do you accomplish the dreams you have? Do you randomly pick steps, do you pick the easiest or most likely result you know you can achieve or do you set a goal that will stretch you?

Planning Gives You Direction

Significant dialogue with yourself and your spouse is required to move ahead with success. Who is helping you set goals, encouraging you to dream and providing a plan of direction?

Here is where a professional, holistic financial advisor can guide you thru the stages: discovery of what you truly value, setting realistic goals, dreaming of the potential and then developing a comprehensive plan to work towards achieving your dreams.

To Your Financial Goals and Dreams,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation.

What is Real Wealth?

STEWARDSHIP CENTS NEWSLETTER

A simple question yet difficult to answer. Real Wealth is about more than dollars and cents. Yes, the size of your account and overall net worth are important; these are important measures. But wealth can be measured in many other ways and looks very different from one person to the next. To one person wealth is all about their pocket book size; to another wealth is possibly having a clean bill of health. For others, wealth is about giving away as much as possible or using the time their wealth has created as an opportunity to do what they really want to do… what can be considered financial freedom. Only you (and your spouse if married) can answer this. Ultimately, you will use and spend your money on what you believe is important, those things you truly value.

Whatever “wealth” may mean to you, it comes from what you value. So the real question is “what do you value?”

The challenge that I have for me and I have for you is to ask the following three questions:

What do I Value?

What is most important to me?

How does this change my life and goals?

Like I said, defining Real Wealth is about more than dollars and cents. It is a difficult question but well worth the effort to answer it! Between people, no answer is exactly the same or is there one correct answer. My firm, Foley and Foley Wealth Strategies strives to help our clients answer this.

I would love to hear your thoughts on this! Please send your comments to me at luke.fields@raymondjames.com. Hope you discover what real wealth means to you.

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

How Taxes Can Help You

3 Ways Filing Your Tax Return Can Help You

STEWARDSHIP CENTS NEWSLETTER

I will be the first to state I don’t like paying taxes but they are a fact of life. They are not optional. Bad things, very bad things can happen to those who don’t pay… how about a tax lien or jail. However, good things can possibly come from filing your return.

About now you are saying, “Luke you are crazy! How can filing my tax return help me?!!” Ok, before you delete this and never read Stewardship Cents again, stick with me- let me explain.

Filing your taxes:

1.) Forces You To Take Inventory and Get Organized (ok, somewhat organized). Who can’t use a little spring cleaning of financial records? The process of gathering and organizing to complete your taxes is usually helpful. Were you reminded of an account you forgot you had? Did you realize you have too many various accounts? You have to know what you have and where it is at in order to manage it well.

1.) Helps You To “Gauge” What the Year Was Like. Life and your business can get busy. So busy, that it is hard sometimes to stop and measure things. Did all of your accounts perform as expected? Did your insurance premiums increase? How much did you save for retirement last year? Did you pay a lot more tax than expected?

“Any enterprise is built by wise planning, becomes strong through common sense, and profits wonderfully by keeping abreast of the facts.” -Prov 24:3

2.) Allows You To Plan Ahead. This is where a CPA who helps you tax plan may be invaluable. Are there areas where you could have saved more, given more or reduced spending? Will your situation this year be similar or different from last year and do adjustments need to be made? Take steps now to plan ahead.

Shortly following tax season, it is common for clients and prospective clients to reach out to me when they realize they need to rollover a prior employer’s 401k, evaluate an old insurance policy or consolidate their accounts to one advisor. Consolidating your accounts may simplify your life, ease taking an annual inventory and allow for better investment management of your portfolio, since all your holdings can be accounted for and then diversified accordingly.

If one of these areas describes you, reach out to me. We can casually chat and run through your options. See, good can come from paying Uncle Sam- even if it is not that much fun.

To Your Financial Success,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

Choose a Tax Planner

Choose Your Tax Professional Wisely

STEWARDSHIP CENTS NEWSLETTER

It never fails; April 15th rolls around each year and its time to settle up with Uncle Sam. I appreciate the following advice. It really applies to me… I like ice cream and I have three kids.

I regularly advise clients to choose their “Tax Person” carefully. You should find someone that fits your needs, is experienced in handling your tax situation and is proactive. For this month’s newsletter, I asked Nathaniel Busch, CPA with BlankenBecler Advisors to contribute his thoughts. Enjoy a cartoon first- this is why you need a professional.

Choosing a Tax Planner versus a Tax Preparer

“As tax time approaches, also comes the decision to choose an accounting professional. It’s important to ask yourself “what type of professional can best fit my needs?”

In the tax accounting industry, there is a clear distinction between a tax preparer and a tax planner.

A tax preparer is a fact finder; one who is presented with information as to what has already happened in a particular year. They are tasked with arriving at an already determinable answer. The client has lost any and all control of the outcome and are at the fate of their tax preparer arriving at the answer before the deadline.

Conversely, a tax planner does not react to a year that has already surpassed a client. Rather, the tax planner is proactive and is an instrumental tool in helping their clients forecast an impending tax liability. By meeting with their clients on an interim basis, a planner can provide the client with a beginning projection of tax liability with several options on how to change their outcome and maintain the effective tax rate their household will pay to the government. This approach gives control to the client as to what their outcome will be, when signing their 1040 in April.

Actual tax preparation for the tax planner is easy – much of the leg work has been completed several months prior, with the likely result already made known to the client.

For many taxpayers, inaction and a failure to plan have already forced their hand – their need is only for a tax preparer, coupled with the uncertainty of what they may owe in the next few months.

As April 15th nears, ask yourself – do I need a preparer or a planner?”

Nathaniel D. Busch, CPA

BlankenBecler Advisors, Inc.

614-475-7560

Feel free to reach out to me to suggest a qualified tax planner, like Nate to meet your appropriate tax needs.

To Your Financial Success,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

You should discuss any tax or legal matters with the appropriate professional. The tax advise and/or services of Nathaniel D. Busch and BlankenBelcer Advisors, Inc. are independent of RJFS.

Did You Know You NEED This?

STEWARDSHIP CENTS NEWSLETTER

Did You Know You NEED This?

The start of school is usually a harsh wake up call, at least for my family. Leaving my house for work a few days before the first day was to begin, I thought to myself… “it is time for a routine again”. It seems the flexibility that summer break offers is a “double edged sword.” Although being out of school is a nice break from the normal school-week-grind for kids (and parents too… no packed lunches or crazy schedules), it also offers little to no structure… or routine. If you are a grandparent reading this, you remember this, right?

Now don’t get me wrong, it is wonderful to not have a schedule some days or for a short period of time, but after a while it can become disruptive. My kids wouldn’t admit it but they were ready for school. They just didn’t know it.

Why We ALL Need Routines

Most adults also don’t realize the need for a routine or process in their lives. Routines are good across the spectrum of our daily lives from eating, working, exercising to what time we go to bed. There are numerous physical health, mental well-being and productivity reasons for any routine we take on. Some routines are rather thoughtless; think brushing your teeth. You can do it half asleep reasonably well. Other routines are specific processes that allow us to focus on important subjects. For example, driving a car has a certain process to drive safely and grocery shopping has a certain process to buy everything you need. Processes that come from routines allow us to think deeply and focus on important tasks. Do you have a process for your finances? Having a routine for your financial plan is vital.

What Is Your Routine?

Do you have a process for a financial plan; saving the correct amount of money in the right places, monitoring your progress to reach your goals and making necessary adjustments to your plans?

Specific processes we use at our firm (our routines) allow us to help you establish life goals, create an actual life financial plan, determine an appropriate investment approach and then regularly monitor results. The routines we utilize help us provide you direction, prevent us from forgetting important planning items, allow us to focus on the big picture of you and your goals, helps reduce the emotional response when markets get volatile and provide an overall discipline to stick with the plan. Our processes even keep us on track to regularly meet face to face with clients. Does your advisor do all these things? Are you walking thru life without a professional and qualified financial advisor?

Let us know how we can help you with your financial life plan.

Luke Fields, CFP®

luke.fields@raymondjames.com

877.854.0936

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

![SC_Header_600px2a4bf3[1].png](https://images.squarespace-cdn.com/content/v1/54e22be1e4b0f4a6ba36154f/1441378659077-VE0I5M6O2FJZYQE7SW83/SC_Header_600px2a4bf3%5B1%5D.png)