Choose Your Tax Professional Wisely

STEWARDSHIP CENTS NEWSLETTER

It never fails; April 15th rolls around each year and its time to settle up with Uncle Sam. I appreciate the following advice. It really applies to me… I like ice cream and I have three kids.

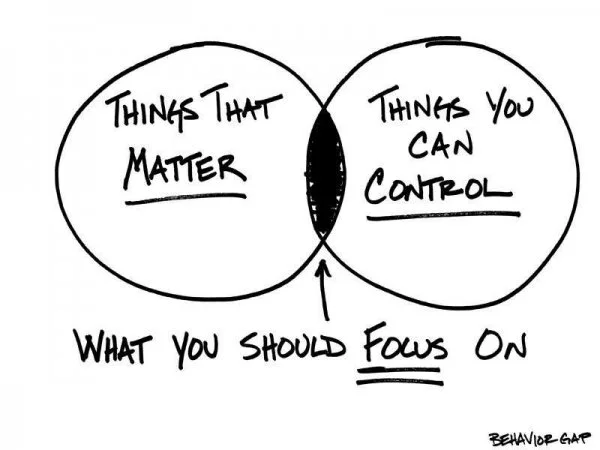

I regularly advise clients to choose their “Tax Person” carefully. You should find someone that fits your needs, is experienced in handling your tax situation and is proactive. For this month’s newsletter, I asked Nathaniel Busch, CPA with BlankenBecler Advisors to contribute his thoughts. Enjoy a cartoon first- this is why you need a professional.

Choosing a Tax Planner versus a Tax Preparer

“As tax time approaches, also comes the decision to choose an accounting professional. It’s important to ask yourself “what type of professional can best fit my needs?”

In the tax accounting industry, there is a clear distinction between a tax preparer and a tax planner.

A tax preparer is a fact finder; one who is presented with information as to what has already happened in a particular year. They are tasked with arriving at an already determinable answer. The client has lost any and all control of the outcome and are at the fate of their tax preparer arriving at the answer before the deadline.

Conversely, a tax planner does not react to a year that has already surpassed a client. Rather, the tax planner is proactive and is an instrumental tool in helping their clients forecast an impending tax liability. By meeting with their clients on an interim basis, a planner can provide the client with a beginning projection of tax liability with several options on how to change their outcome and maintain the effective tax rate their household will pay to the government. This approach gives control to the client as to what their outcome will be, when signing their 1040 in April.

Actual tax preparation for the tax planner is easy – much of the leg work has been completed several months prior, with the likely result already made known to the client.

For many taxpayers, inaction and a failure to plan have already forced their hand – their need is only for a tax preparer, coupled with the uncertainty of what they may owe in the next few months.

As April 15th nears, ask yourself – do I need a preparer or a planner?”

Nathaniel D. Busch, CPA

BlankenBecler Advisors, Inc.

614-475-7560

Feel free to reach out to me to suggest a qualified tax planner, like Nate to meet your appropriate tax needs.

To Your Financial Success,

Luke Fields, CFP®

Any opinions are those of Luke Fields and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

You should discuss any tax or legal matters with the appropriate professional. The tax advise and/or services of Nathaniel D. Busch and BlankenBelcer Advisors, Inc. are independent of RJFS.

![SC_Header_600px2a4bf3[1]](http://static1.squarespace.com/static/54e22be1e4b0f4a6ba36154f/55783de2e4b0074df64cd770/55783de2e4b0074df64cd7db/1361823034000/SC_Header_600px2a4bf31.png?format=original)